Here’s Part 9 of the Marketing Performance Index. In this installment, I’m sharing how by building Market Presence and Brand Strength, your Pipeline Health can improve dramatically. With this approach, you can:

📊 Boost Performance: leverage the interrelationship of all 24 key marketing performance metrics

🎯 Target KPI’s: identify the best areas to improve performance at the lowest cost per opportunity

🔄 Leverage Insights: from each performance indicator to boost returns in related areas

📚Learn & Improve: track results over time across measurement components to raise your scores

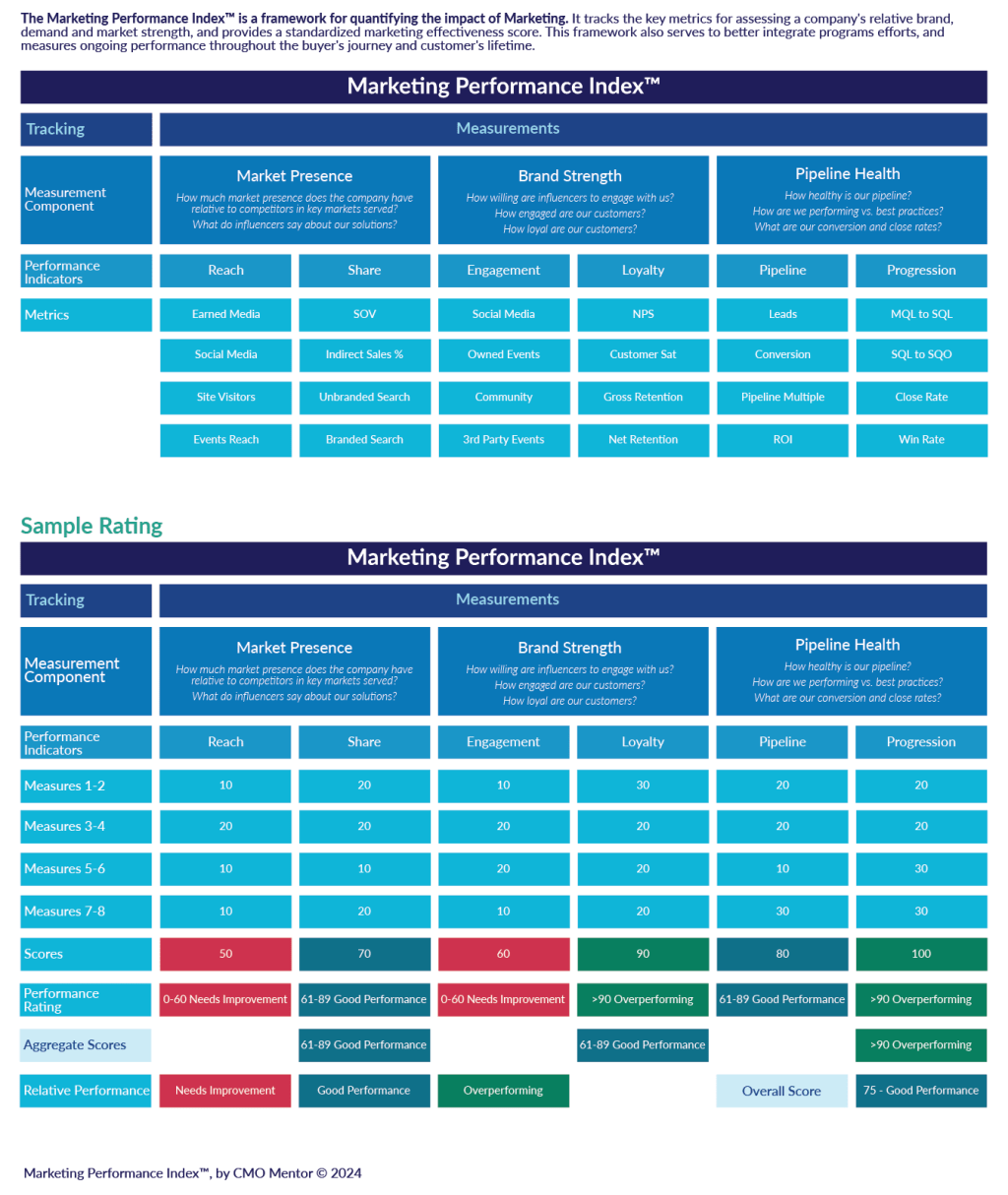

In my previous eight blogs on the Marketing Performance Index (MPI), I explained why I created the MPI, how it’s constructed, how it works, and how easy it is to create your own benchmark in about an hour. I’ve also shared the definitions for the 24 key metrics it tracks across the three main areas of Market Presence, Brand Strength and Pipeline Health, and provided tips and techniques to improve performance in areas where any particular score is below industry benchmarks and/or target results.

Now, I’m going to examine the interrelationship between Market Presence, Brand Strength and Pipeline Health. There are many companies who primarily focus on creating and converting pipeline. If your company can consistently meet or exceed its ongoing bookings and revenue targets, there’s nothing wrong with that approach. In fact, in the current environment, many of my CMO peers have had to reduce budgets and experienced such increasing pressure to produce pipeline, that it’s easy to see why concentrating on generating and progressing pipeline can become priorities one, two and three. To me, however, an over-rotation to tactics and investments that have the most direct impact on boosting near-term pipeline growth is very short-sighted and, while it often works in the short-term, it typically produces sub-average results over the long run.

I’ve also seen a growing number of CMO peers make a positive correlation between brand and demand. Some have even asserted that brand strength is, or is becoming more important than demand in boosting marketing and company performance. While I applaud taking a provocative or counter-trend position, it’s also too narrow a view into why some companies outperform others on a consistent basis. There are always more variables at play that determine relative marketing performance (i.e., relative to peers and industry benchmarks, as my two year tracking study of the Marketing Performance Index demonstrates).

In my 20+ years of leading marketing organizations, from startups to over $1 billion in revenue, the combination of better than average Market Presence + Brand Strength + Pipeline Health = consistent overperformance relative to peers. Here’s a simple explanation. Market Presence has two key performance indicators, Reach and Share. Reach is about growth in: all types of Media coverage, the number of social media followers, the number of unique site visitors, and presence at key industry events. Share is about your share of voice vs. key competitors, your percentage of indirect sales via channels and/or distribution partners, your relative number of site visitors based on paid and organic search. So if you are growing beyond the market average in these measures, and outperforming the competition, you will be seen by more prospects and often by a wide margin. All purchase cycles follow a progression from awareness to consideration to purchase. And even if you have a relatively higher conversion percentage from leads to opportunities to closed won business, if you have say only 25% of the “at bats” of your closest competitors, you won’t close the gap in opportunities and revenue attainment.

The same principles hold true with how Brand Strength positively influences Pipeline Health. Brand Strength has two key performance indicators, Engagement and Loyalty. Engagement is about your firm’s relative level of engagement in key social media sites, growing the number of attendees at events, growing your communities of interest (online or in person). And Loyalty is about having better than average scores for standard measures like NPS and CSAT, as well as better than average Net Retention and Gross Dollar Retention (particularly for SaaS companies). Again, if you have higher engagement, larger, involved customer communities, and relatively higher retention, then it stands to reason that you will win more business and grow revenue faster than your competition.

So , in closing, while you can do many things to improve Pipeline Health (more tips and tactics will be shared in future blogs), improving each of your component scores over time in both Market Presence and Brand Strength positively influences your success in achieving and sustaining Pipeline Health. A key measure of Pipeline Health is Marketing ROI, i.e., the return on every dollar invested in Marketing. It just stands to reason that if prospects don’t know you, don’t fully grasp your value prop, don’t have the breadth of experience interacting with your company relative to peers, you’re likely going to have to spend more money per dollar of pipeline your create, and will also need a higher pipeline coverage multiple to achieve your bookings and revenue targets.

Over the past several months, I’ve been doing a baseline diagnostic for many marketing leaders and peers, and in every case, the numbers tell a story and suggest many new avenues to improve performance. If you’re interested in a free diagnostic to see how your marketing and company performance compares to industry benchmarks, just send me a note and we can schedule a call. It takes about an hour to compile your confidential score and you the calculation sheet to continue your own measurements going in the future. Happy improving!

#B2B #CMO #BoostMarketingPerformance #PlayToWin