Brand and Demand go hand in hand. Most CMO’s agree. The problem is CEO’s, boards and investors don’t want to invest in a brand unless it can be proven to increase demand, and revenue in a material, cost-effective manner. There’s a lot discussion in CMO forums and peer groups on why it’s so important to continually build brand, and one of the main reasons is because 90% or more of most target buying groups are NOT currently in the market for a new solution except every few years- so you need to be top of mind when they are.

Recently, Jon Miller posted a very compelling argument for investing in brand: “A strong brand means: you’re the first one buyers contact when they’re ready; you win more deals, faster, and with less discounting; you retain more customers since they’re excited to work with you; and every demand gen program works better, or more simply put, brand investment = pipeline insurance.” Jon is also partnering with Ray Rike at Benchmarkit, Bill Macaitis, and Carilu Dietrich on the first ever B2B “Brand vs Demand” benchmarking study. This upcoming study will illuminate how marketing leaders are investing in brand vs. demand across various industry segments, and give marketing leaders the context they need to make informed long-term growth investments.” But you don’t have to wait for the release of this study to start tracking and realize the benefits of brand building driving demand in a very significant manner.

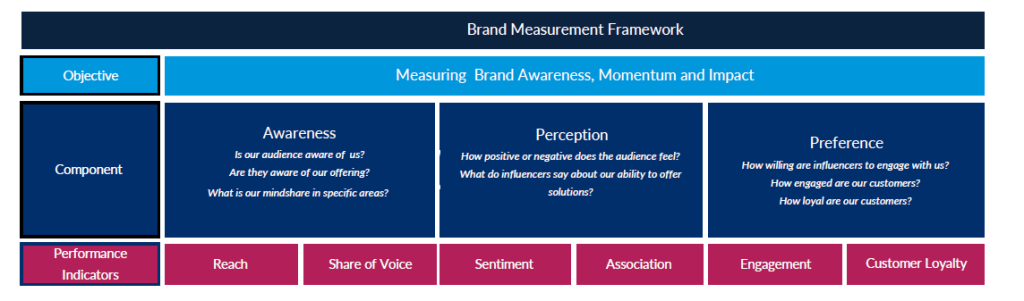

While CMO of Emburse from 2019 to 2022, I created a brand measurement framework, with help from Forrester, to track the impact of brand on demand, pipeline and bookings. This framework is shown below and it is fairly straightforward to implement at almost any B2B company. There are three broad areas to measure: awareness, perception and preference. And the six indicators along with key metrics associated with these measurement areas are: reach, share of voice, sentiment, association, engagement and loyalty.

My team and I helped launch Emburse (as a branded house representing what were previously seven separate businesses) in January of 2020, just before the world virtually shut down due to the global outbreak of COVID. With our primary offering being a SaaS-based Travel and Expense offering, we experienced a significant slowing in our business. However, due to an aligned executive team embracing an agile approach to go-to-market, product and services innovation, the company diversified revenue streams and regained momentum throughout the year as the outbreak slowed, and the pace of business picked back up.

I tracked 12 distinct metrics associated with the six performance indicators over a 2-year period. Below is a chart with the tracking results demonstrating how the brand investments helped improve pipeline efficiency, increasing performance by 50% over a 2-year period.

As long as a company can gather the requisite key performance indicators (KPIs) on a regular basis, it can become a very straightforward and systematic process to track KPI’s to assess the impact of key brand-building tactics on awareness, consideration and purchase, and demonstrate the impact of brand building on creating stronger demand and a more efficient pipeline. If you’d like a free consultation on how to set up a brand measurement framework like this, or share what’s working now in your business and industry, just drop me a note.